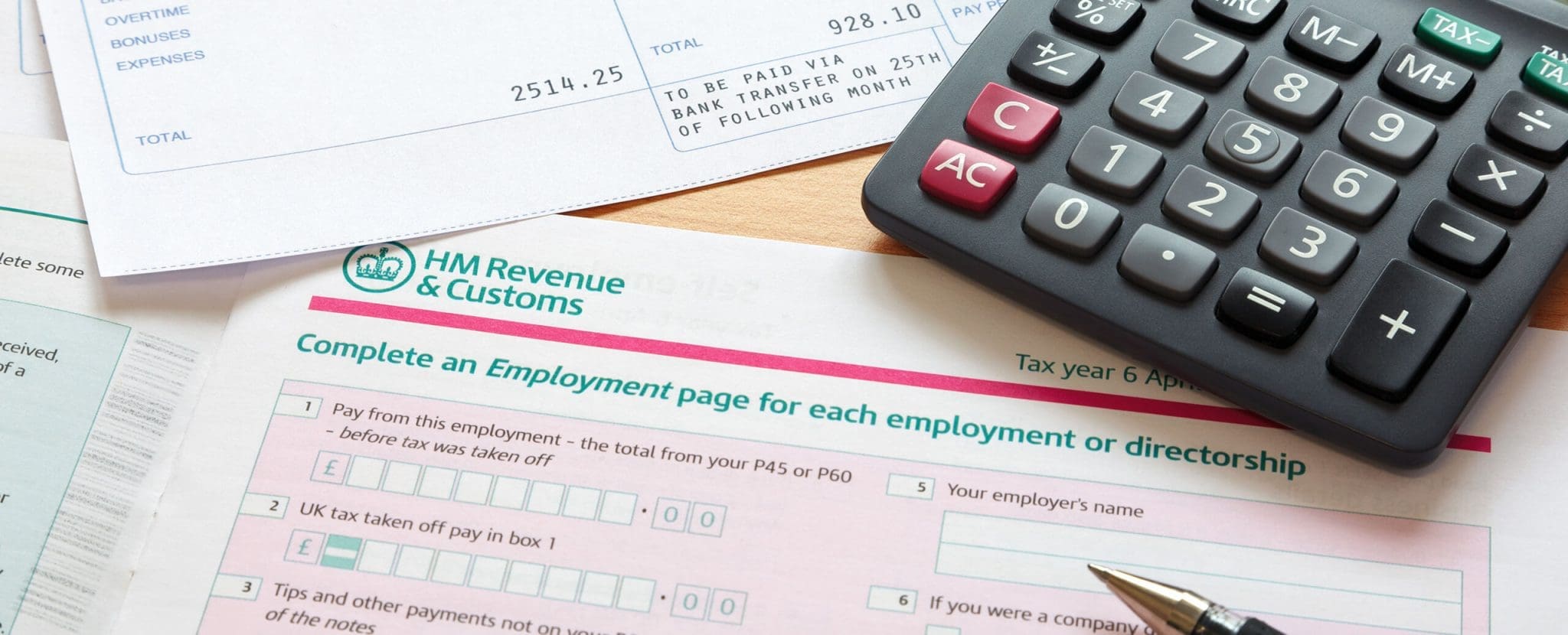

Self Assessment Tax Return Accountants

Self-assessment tax returns aren’t the easiest things to get your head around, especially if you’re trying to do it yourself. This is because everything from the registration process to declaring your income and deductibles involves a lot of expert know-how that only an accountant for tax returns has.

You don’t want to worry about completing your tax return forms incorrectly and suffering from high fines and penalties. That’s why Braant is here to help. Our team consists of trained tax return accountants with years of experience that can put your mind at ease by helping you complete your self-assessment tax return as seamlessly as possible.

“Excellent company to work with. I had some reasonably complex tax matters needing to be sorted out and then get my tax filed before the required deadline. What I liked was the no hustle, positive approach taken from the start and this continued all through the process. A pleasure to do business with.”

Our accountants for tax returns are here to help

Trying to figure out a self-assessment tax return form without prior knowledge or help can be incredibly stressful, and that’s why the experts at Braant are here to help. We will work with you and determine what tax bracket you fit into based on your income and expenditure.

Our tax return accountants know the best ways to minimise your tax liability so you net more every tax year. We know the deadlines and relevant filing processes to ensure you don’t face any penalties.

Get in touch with one of our professional tax return accountants if one of the following applies to you:

- You have earned more than £1,000 in the last tax year while registered as self-employed

- You are part of a business partnership with someone else

- You have earned more than £100,000 via PAYE in the last tax year

- You have any form of untaxed income

Contact us today – to discuss your self-assessment tax return.

We have the resources, the experts, the knowledge and experience to help your business grow. And with over 1,000 accountancy clients in the UK and London, the volume of our work allows us to share economies of scale with you.

There are numerous other sources of income that you need to declare on your tax return, such as…

- Money from renting out a property

- Tips and commission

- Income from savings, investments and dividends

- Foreign income

Who we support

Whether you’re a sole trader, an SME, a non-UK business or a large corporate, we can provide you with full service accounting support.

Over 1,000 clients rely on Braant Accountants for services ranging from bookkeeping and self-assessment, through VAT and annual company accounts to long-term financial and tax planning strategy.

These clients operate in a multitude of industry sectors and they choose us because we understand the accounting challenges specific to these sectors.

Contact us today – to find out more about our self-assessment tax return services.

We have the resources, the experts, the knowledge and experience to help your business grow. And with over 1,000 accountancy clients in the UK and London, the volume of our work allows us to share economies of scale with you.